What is Income Annuity?Annuities are sold as simple, long-term investment products. In their most basic form, you give an insurance company an amount of money, called a premium, either in a lump sum or periodic payments. In return, you may elect to receive a steady stream of payments over time.

An income annuity is a life insurance contract that is designed to start paying income as soon as the policy is initiated. Once funded, an income annuity is annuitized immediately, although the underlying income units may be in either fixed or variable investments.

|

WHY CAN Income Annuity YIELD BETTER THAN 4%?

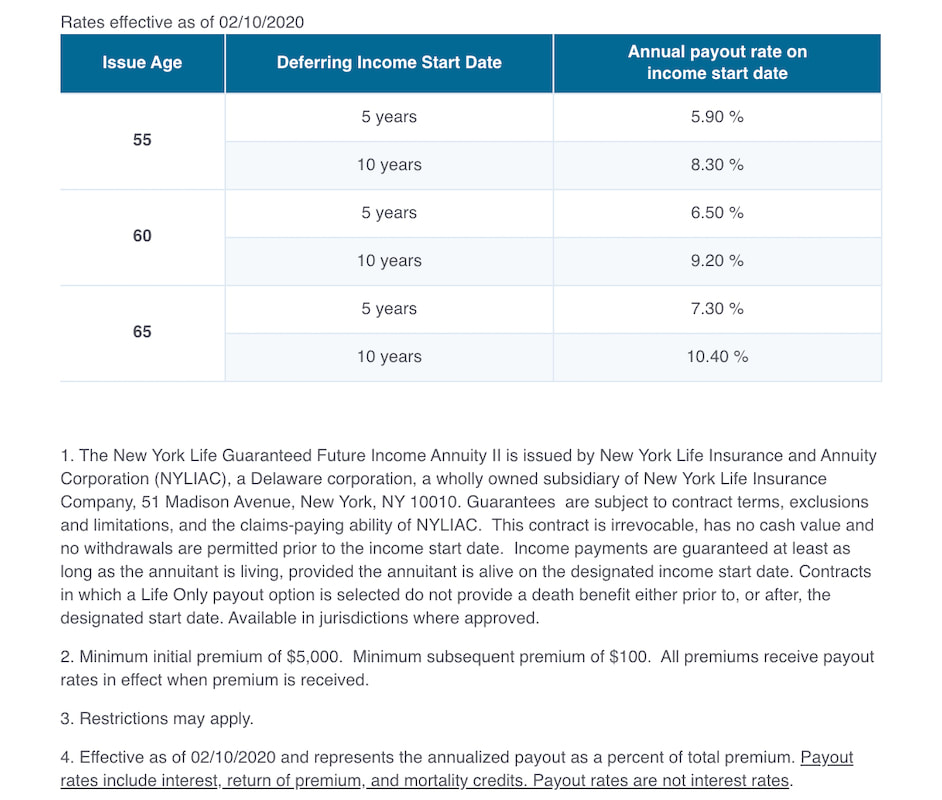

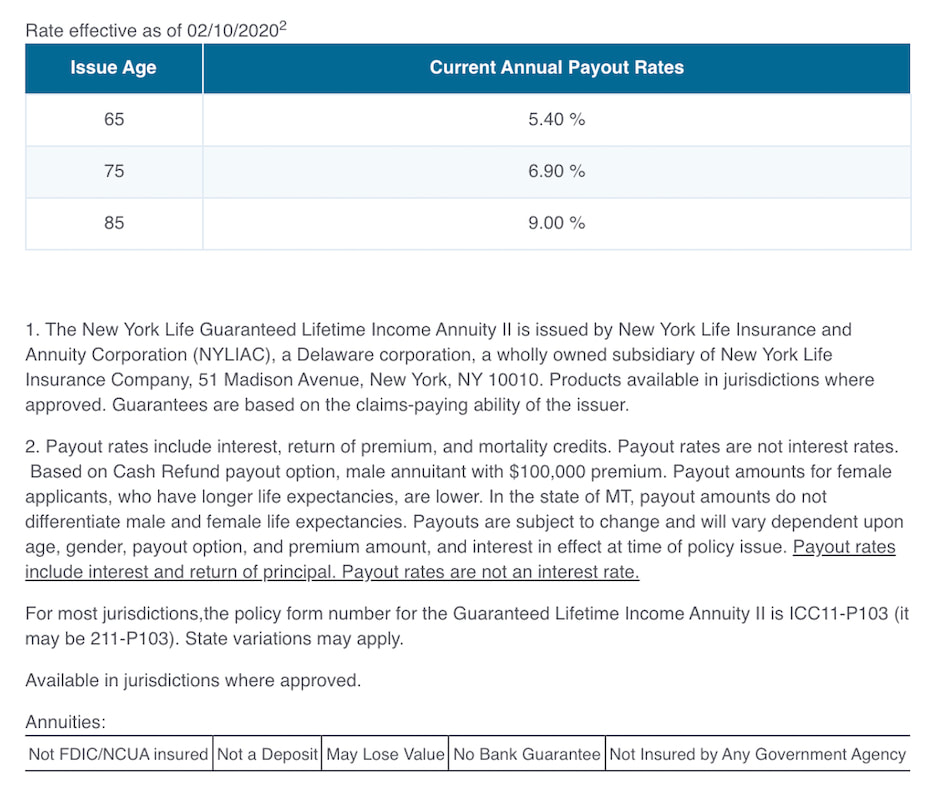

As income annuity examples, the New York Life Guaranteed Future Income Annuity II and the New York Life Guaranteed Lifetime Income Annuity II offer a secure way to help guarantee that you have the retirement income for your entire life a shown below.

|

HOW TO INVEST IN Income Annuity BY YOURSELF?

|

|

Annuity.org provides Financial Planning, Insurance and Retirement Resources.

|

Pros:

|

Cons:

|