WHAT is Option Writing?Many investors and advisers may be skeptical about options strategies, citing their use of leverage, their complexity and the propensity for most options to expire worthless, not to mention the costs. An equity index put/call write strategy, however, is unlike other options strategies in that puts/calls are written on indexes, not individual stocks. There is no leverage because the portfolio is fully collateralized.

|

WHY CAN Option Writing YIELD BETTER THAN 4%?

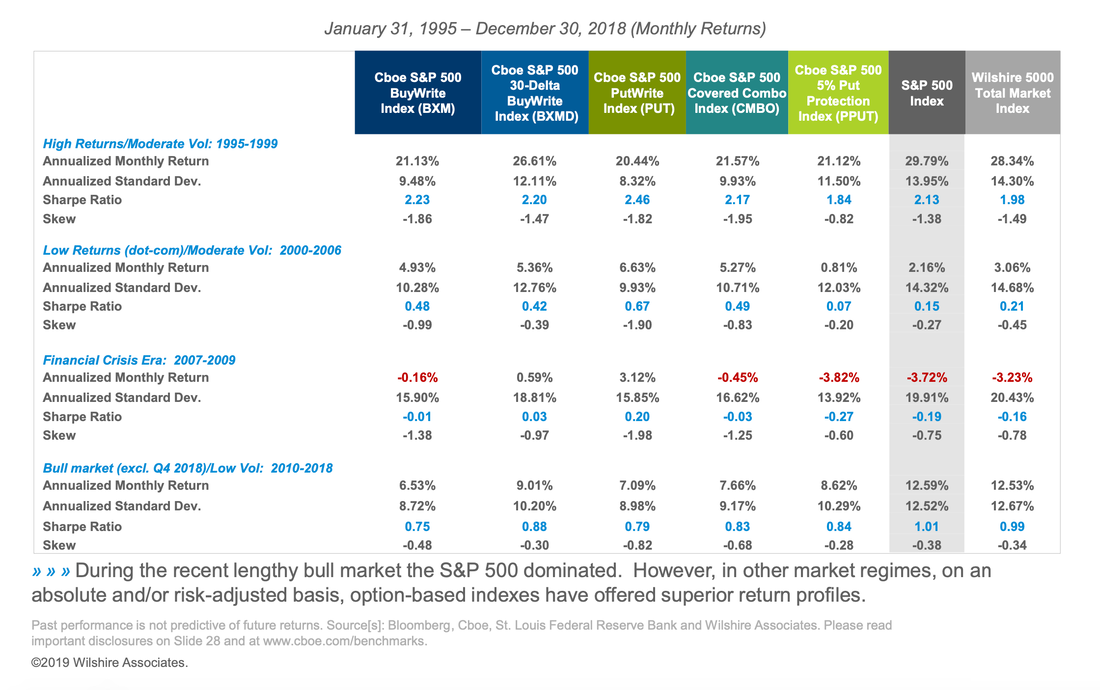

According to the research done by Wilshire Associates for Cboe, option overlay strategies have an attractive risk/return profile over time as shown below.

|

HOW TO INVEST IN Option Writing BY YOURSELF?Generally, one call/put option is written for every 100 shares of index ETF owned (e.g., SPY). The writer receives cash as income for selling the call/put but will be obligated to sell the ETF at the call's strike price or buy the ETF at the put's strike price if assigned.

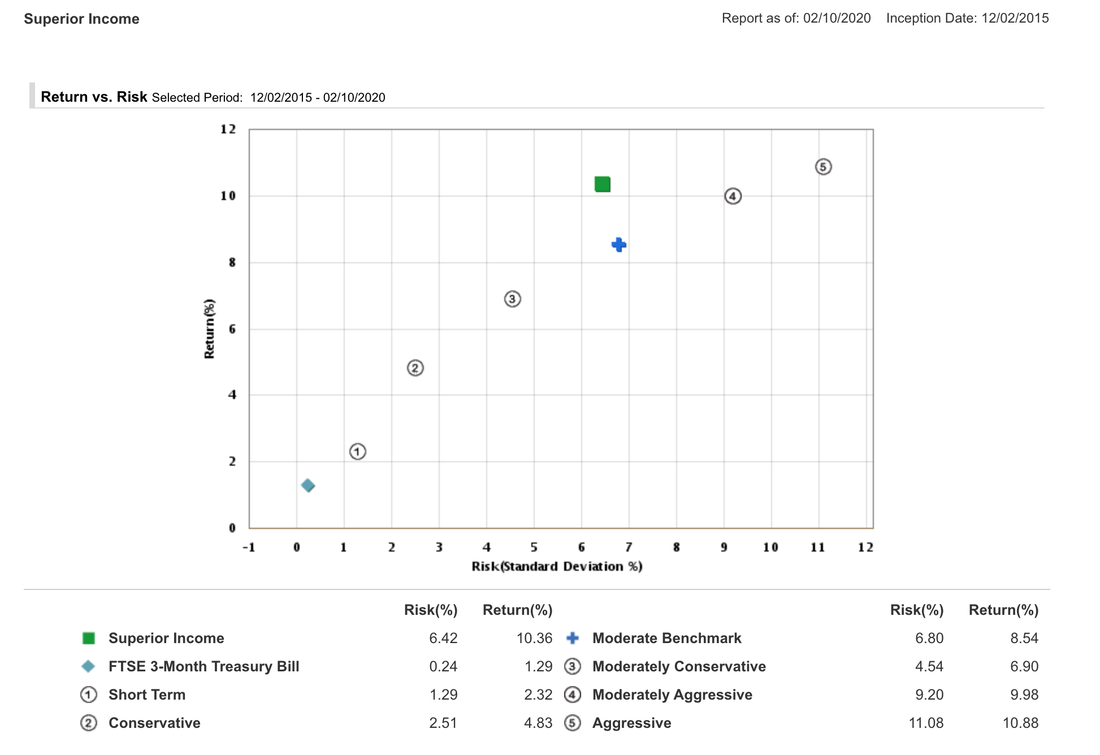

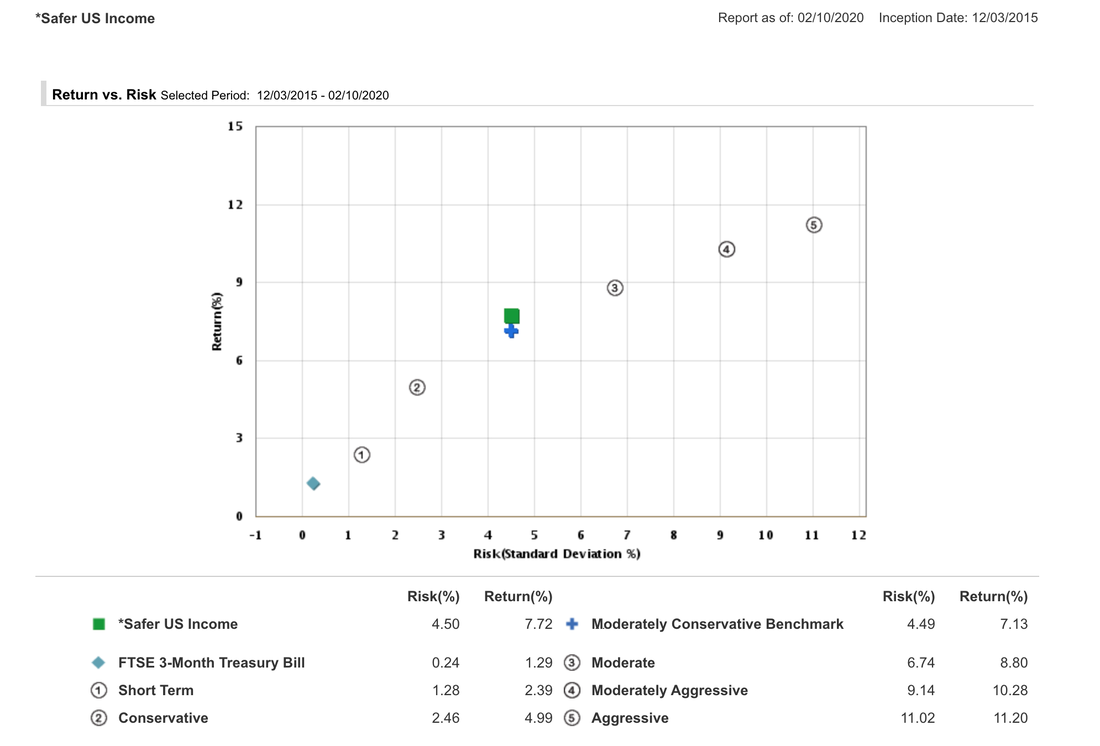

Option writing strategy has been incorporated into ETF income portfolios to generate enhanced high-income with even better risk/return profiles. Here are two actual hybrid option-ETF portfolios with left using put-writing and right using covered call to achieve high-income lower-risk performance over the given period .

|

|

CBOE Equity Option Strategies - Covered Calls

CBOE Equity Option Strategies - Cash-Secured Puts |

Pros:

|