What is Closed-End Fund?A closed-end fund (CEF) is a portfolio of pooled assets that raises a fixed amount of capital through IPO and then lists shares for trade on a stock exchange.

|

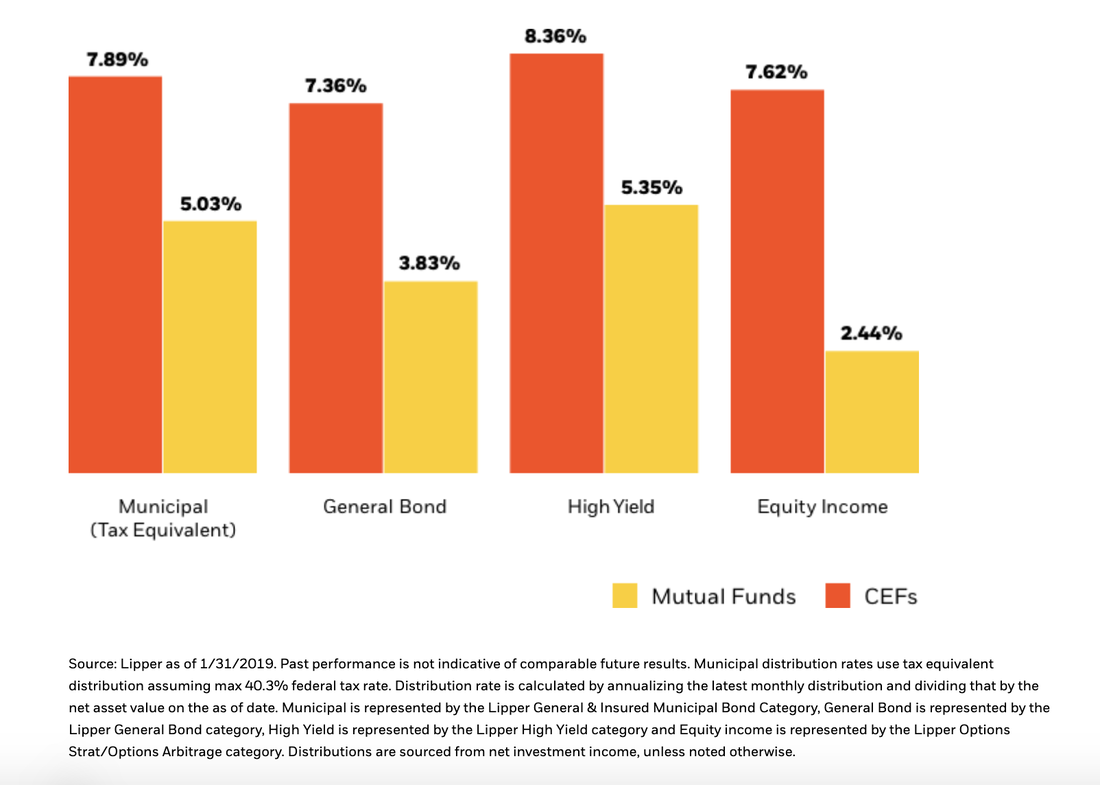

WHY CAN Closed-End Fund YIELD BETTER THAN 4%?Most CEFs pay distributions on a monthly or quarterly basis. In many cases, CEF distribution rates exceed those of comparable investment vehicles such as mutual funds.

Leverage is a strategy that can be employed by CEFs in an effort to achieve a higher rate of distributable income and potentially enhance returns. Although there are several potential benefits of using leverage, investors should consider the potential for increased risk and volatility prior to investing in a leveraged CEF.

According to a study done by BlackRock, CEFs may offer higher distribution rates than comparable investment vehicles such as mutual funds as shown below.

|

HOW TO INVEST IN Closed-End Fund BY YOURSELF?

|

|

CEFConnect provides unbiased, straightforward, and comprehensive closed-end fund information.

|

Pros:

|

Cons:

|