Welcome to LifetimeIncome.org, a research and education information site created and sponsored by AFIEA (Alpha Financial - Innovation Excellence Advisors). It serves as a guideline for those investors seeking high-income investment strategies. We emphasize potential hidden risks that are often neglected by many investors and their financial advisors. Let’s work together to empower ourselves to see through Wall Street!

The Problem

|

Retirement Income Planning is the Hardest and Nastiest Problem in Finance (Source: Nobel Laureate William F. Sharpe, Stanford University, Jan 2019)

There are lots and lots of possible future scenarios. You can cut down the investment uncertainty by just basically having Social Security… and an inflation-indexed-based annuity. But, even then, you’ve got to make choices about whether it will be a joint annuity, for how much, and when you’ll buy it. It’s a tough, tough, tough problem.

|

It's a rule of thumb that says you can withdraw 4% of your portfolio value each year in retirement without incurring a substantial risk of principal. Many investors and financial professionals believe this rule is based on solid academic research. Wrong! Here is why:

The 4 Percent Rule is Not Safe in a Low-Yield World (Source: Journal of Financial Planning, Jan 2013)

Estimating a withdrawal rate from retirement assets that will preserve capital over a long life requires assumptions about future asset yields. Current bond yields are at historical lows... With no real bond yield, hypothetical retirees experience a one in three chance of running out of money after 30 years with a 50 percent stock portfolio. If the current negative real yields on five-year bond investments persist, the probability that one will run out of money is greater than 50 percent.

The Stunning Problem with the 4% Retirement Income Rule (Source: Robert Pagliarini, Forbes, Jan 2020)

Assuming you started to withdraw income when your portfolio value was at the top of the market cycle. When your portfolio experienced negative returns early on, it was never able to recover even with the high returns later on. Your portfolio got stuck in a hole, and with the 4% withdrawals each year, it was too little and too late. This is not the outcome you want in retirement.

The Solution

The first step is to come up a retirement planning goal. The Ballpark E$timate® is a calculator that can help you to estimate your future savings and spending for your retirement. The tool takes complicated issues like projected Social Security benefits and earnings assumptions on savings and turns them into language and mathematics that are easy to understand.

|

After that, LifetimeIncome.org and IncomeDIY.com presents high-income solutions that can yield sustainable long-term income stream better than 4%, including

|

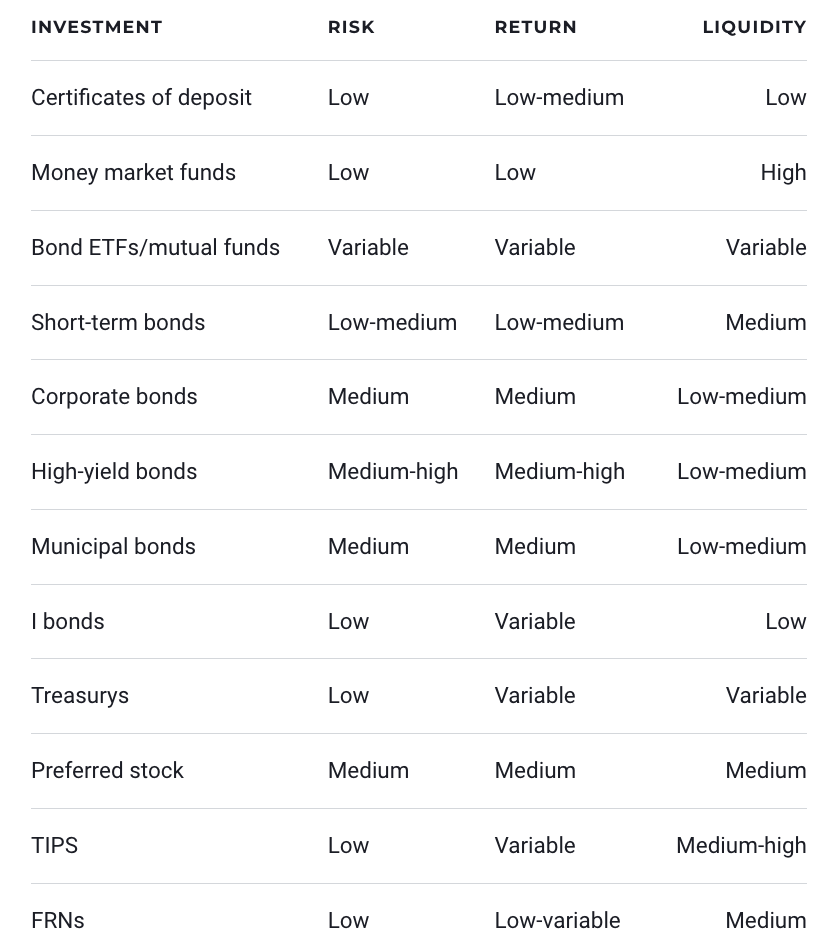

Given the current low interest-rate environment, CDs, MMFs, low-dividend stocks, and low-yield bonds are not considered as sustainable income choices.

In November 2019, Barron's interviewed William Sharpe and published Nobel Prize-Winning Economist on How to Solve the ‘Nastiest, Hardest Problem’ in Retirement. Here are a few key points on developing better income solutions:

Why is creating sustainable retirement income such a hard problem?

When you retire and make your initial decision on buying annuities, investing, and adopting some sort of spending plan, I would think that it would make sense to sit down at least once, at the outset, with a financial advisor. I don’t necessarily advocate paying 1% of your assets to an advisor indefinitely.

Why is it harder for individuals to make a decision?

Right now, you tend to have investment advisors for retirees, and insurance advisors or salespersons for retirees, and it’s fairly rare to go to somebody who can sell you annuities or invest your money and has no financial incentive to tilt one way or the other. Ultimately, what I’d like to see are people who have knowledge of both annuities and investments, and who are compensated in a way that doesn’t influence the decision.

Do you have an advice for the do-it-yourself retiree?

I would go online and learn something about annuities so you understand that set of options tolerably well. Almost certainly, robo-advisors will start building products for that person.

At LifetimeIncome.org, we are striving to provide free, unbiased, and up-to-date educational information to help investors understand high-income investment and annuity choices. Reliable and authoritative online tools and resources are provided and continuously updated. The pros and cons of each strategy are summarized for your further research.